Why ESPN?

If you know sports, you know ESPN. Be it about the Super Bowl or an Australian Open, people from all walks of life visit ESPN or tune into its TV channel to check the sports events.

For readers, ESPN is a hub to provide them with sports news and updates about the favorite players. For us, ESPN is an interesting story with tons of takeaways. We know it isn’t just fandom that makes ESPN initiatives a great success — the publisher does it right every time.

But it didn’t start that way. ESPN had its good days and its bad days. It had a couple of flops and lessons to become the #1 sports website it is today. In this becoming piece, we have outlined how ESPN’s marketing, advertising, and strategies helped the media business to grow.

Let’s see how they started.

How it all started?

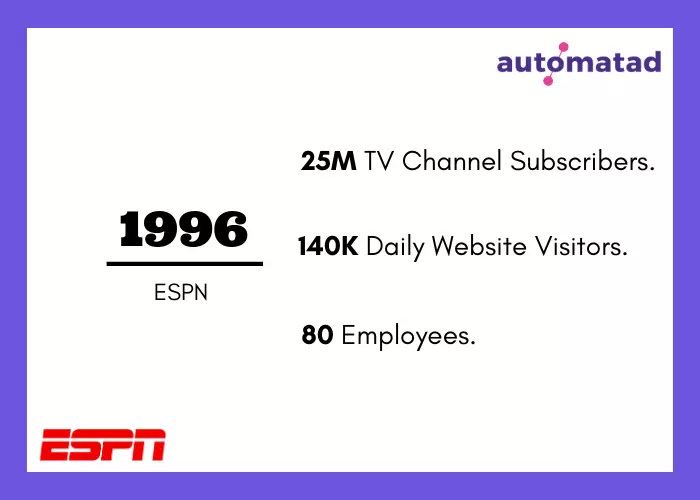

In the late 90s, Media and entertainment companies were bewildered as the audiences were gradually shifting from print to the Internet to stay updated and consume content. Realizing the trends, ESPN, a leading TV channel in the sports industry, announced the launch of ESPN website (as ESPN SportsZone) to shape the way media covered sports. ESPN TV channel had Subscribers ~25 million (Src) and 80 employees. Impressively, ESPN website attracted 140,000 daily website visitors.

Where they are today?

In the past few decades, ESPN had gained ground and transformed the TV’s scripted shows to interactive video programming on the web. The ESPN website receives 85.75% of the traffic from the United States, and nearly 76% of traffic is organic. Besides, the publisher has several million subscribers over connected TVs and OTT devices. According to SimilarWeb, ESPN website has 343.84 million monthly unique users and its operating earnings was at $3 billion in 2019 (Src).

Today, ESPN is the world’s leading provider of sports entertainment and has the most diversified portfolio of digital sports assets among its peers. The publisher has television networks, websites, blogs, radio channels, restaurants (yup), and so on.

Becoming ESPN

From Cable Network To Digital Pioneer

1995 – 2005

Website Launch

Disney, the parent company of ESPN, announced the presence of Sports on the web. The Entertainment and Sports Programming Network was now available at ESPNET.Sportszone.com. However, the domain name was later renamed as ESPN.go.com in 1998 (Src), and eventually ESPN.com in 2016 (Src).

When Disney launched the ESPN website, it may seem to have an established audience. However, the challenge of building an audience on the Internet stands true. Because not all the TV viewers are going to convert to online readers. Besides, the competition amongst sports publishers was on the surge. Yahoo! launched its own dedicated space for sports, and so did Fox Sports in the same year.

However, media influence in the late 90s wasn’t restricted to cable TV channels. Radio programming was also contributing to increased interest in sports as hundreds of radio stations across the country adopted sports programming around-the-clock.

So, to score points against the competitors and increase brand awareness, the publisher purchased the WMVP-AM radio network in Chicago and changed the name to ESPN Radio 1000.

ESPN Radio Programming

It wasn’t new to the publisher. ESPN has been leveraging radio since 1992. This raised a question in our head, why would the publisher buy a radio station for $21 million when they already had their own radio station (Src). To get the answer to this question, we dug down and found out that WMVP-AM was the biggest competitor of WSCR-AM 1160, the most popular radio station in the area.

WMVP-AM which already had millions of subscribers, was now part of ESPN. Via ESPN 100 Radio, the publisher aggregated the breaking news from various ESPN divisions (ESPN2, ESPN Radio, and ESPNET SportsZone). And, it worked well.

In the next few months, ESPN introduced a new dedicated radio station – ESPNEWS Live Audio. Live Audio aired the same content as that of ESPN with some additional twists. But, to get access to it, a listener had to buy a subscription.

“The past year featured many exciting new beginnings with ESPNEWS, other launches overseas and a new corporate parent. We continue to remain true to our mission — finding innovative ways to provide value to our customers, expanding the business and remaining the worldwide leader in sports.”

– Bornstein, President of ABC Sports.

Before having a website, ESPN heavily relied on TV channels and radio stations to expand the audience base. Due to this, the source of revenue for the publication was TV advertising and radio affiliates. But, ESPN now had a website which required an additional source of income to run the business. So, in the search of new revenue streams, the publisher came across a viable source – digital products.

ESPN Products

For decades, selling digital products has been one of the key strategies to monetize a website. Yet, for many publishers, doing eCommerce means mixing content with affiliate links. But, for ESPN, eCommerce meant creating a team of people and turning their ideas into products that would be sold in a matter of days.

Though this was a relatively new opportunity for ESPN, the publisher wisely created CDs and DVDs and opted to sell them. Better known for content creation related to sports, ESPN soon released a book “SportsCentury”. The book that was launched in 1998 is still available today on Amazon and other eCommerce sites at $13.31 (Src).

Digital products acted as a great metaphor for ESPN’s journey trying to shift from usual revenue sources. In the meantime, the parent company, Disney was planning something different for ESPN.

ESPN Zone

Since its inception, Disney has been known as a diverse company with its movie studios, theme parks, cruise ships, and many more. So, the company tried to expand the reach of the ESPN brand by launching ESPN Zone, a multi-level sports-themed bar and restaurant chain.

“I just thought that ESPN had the combination of a really strong culture and it had entertainment. We thought it would be a great mix for us.”

– Art Levitt, president of Disney Regional Entertainment Inc.

The first restaurant was launched in Baltimore of the United States in 1998. ESPN Zone that could hold 550 people at once, did broadcast live and customers were able to watch their favorite sports in the screening room.

Besides, it set up a 10,000-square-foot arena to play virtual games and actual games. ESPN Zone intended to create an environment that provided entertainment as well as a chance for the customers to immerse themselves in the ESPN brand.

“What we’re trying to ensure is that anything in ESPN Zone reflects the personality of ESPN and that’s passionate, outspoken, and authoritative.”

– Judy Fearing, senior vice president of marketing at ESPN.

Though Disney was there to support ESPN Zone, the publisher had to go up against the tough competition with Planet Hollywood, Hard Rock Cafe, and a few others in the same location. The first and foremost challenge was to distinguish themselves from the competitors. Broadcasting sport events live and sticking to what it does well — Sports — helped the publisher.

“It’s the ESPN culture that will differentiate us from anyone else out there. That is the secret to success.”

We aren’t saying that every publisher needs a restaurant to generate revenue. But, we are saying that every brand need to take risks to be successful. And, the path to success requires a bold move and ESPN took the risk and nailed it.

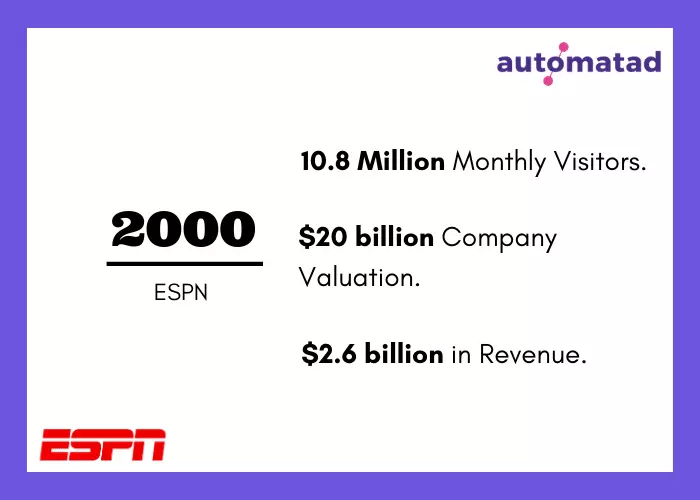

In 2000, ESPN had a monthly website visitors of 10.8 million (Src) and did $2.6 billion in revenue (Src).

Video Streaming Service

For a publisher, traffic volume is as important as the engagement rate of the audience on the website. ESPN has millions of visitors every month, and the majority of them check the website due to the video content format. So, the publisher scrambled to make sure that its audience can view the missed content any time and latest content as soon as they land on the ESPN website.

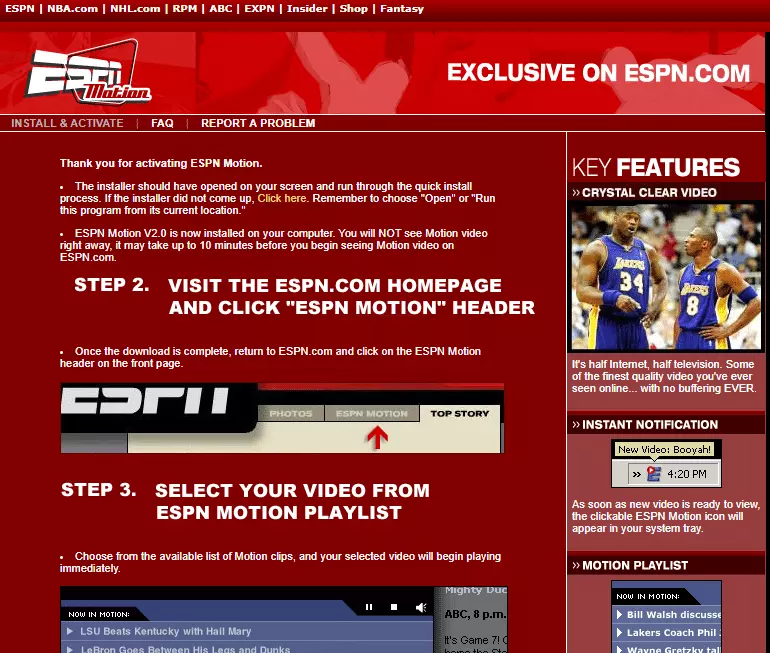

Soon after working on the goal, the publisher launched a video streaming service in 2002 and named it ESPNMotion. It was a means to push video programming directly to the website. Initially, it tested with the subscribers, and after some time, ESPNMotion was accessible to all website visitors. The video programming showcased the analysis from ESPN interviews, reporters, game highlights, and so on (Remember, Cheddar?).

The video streaming service, ESPNMotion, was a free application that visitors had to download on the computer. The technology behind ESPNMotion, Windows Media technology pushed the videos automatically on the website once the visitor loaded the webpage. Besides, people were able to replay the videos in case they missed it.

Not only ESPNMotion helped the publisher to increase the website engagement rate, but it also paved the way for video advertising which was less often explored during the time. By the end of 2005, ESPN Motion had about 2 million video starts per day according to the publisher (Src).

Video publishers have a certain way to think about creating content. And, in the case of ESPN, the publisher knew what video content creation ought to look like as they were dealing with it for decades. However, there was one thing that the publisher didn’t know before – streaming over the internet is different from TV broadcasting.

On the Internet, people want buffering-free video content. So, to make it better for the visitors, the publisher created an in-house tech team to create a product in order to minimize the bandwidth cost of ESPN as well as offer a streaming service that has no buffering issues.

ESPN Motion 2.0 Video Player

It was 2005 when the publisher launched its proprietary video player ESPNMotion 2.0 to improve the user experience. Besides, the goal was to improve video advertising as well. The video player was built on the pre-caching technology and periodically downloaded new videos to the desktop owners’ hard drives. It provided a faster video loading, better than streaming video.

For advertisers, they were now able to embed the links to the video ads. Also, the visitors were enabled to click on the video ads for additional information. Buyers were now buying 300×250 ad units and ran video ads of 15 seconds and 30 seconds.

“Advertisers can also use technology to play commercials. Sega of America is advertising its football video game, Sega Sports “NFL 2K3,” in a 15-second commercial on the site, which premium subscribers can view”

Acquisitions and Advertising

2006 – 2016

Acquisition

Ten years ago, the publisher was more focused on sports like football and rugby. But, it neglected cricket for long. However, in 2007, when the parent company realized a growing interest in cricket among the audience, it took an important step and acquired Cricinfo.

“Growing our business in the online world is vital for us to serve sports fans. Cricinfo is a tremendous property with a great fan base and it will be a strong addition to ESPN.”

– Russell Wolff, Managing Director, ESPN

Cricinfo had 7 million unique visitors at the time of acquisition (Src) and already built a loyal audience base of cricket lovers. Soon after the acquisition of the niche website, Disney renamed Cricinfo to ESPNcricinfo.com in 2009 and also integrated it into the ESPN suite of products.

“With this relaunch, we wanted to leverage both the ESPN and Cricinfo brands to expand awareness of them both – taking advantage of their individual strengths in particular markets to help expand the awareness of the other as a brand that stands for the world’s best sports coverage.”

– Tom Gleeson, Vice President ESPN Digital Media

Wondering if the acquisition of Cricinfo was successful? Absolutely. ESPNcricinfo had 13.7 million monthly visitors and an engagement rate of 672 million user minutes in two consecutive months (April and March) in 2009 (Src) and as of now, 88 million users visit the website every month according to Similarweb data.

Though the current strategies were performing well, Disney wanted more for ESPN as it saw the growth of audience towards new media.

Going OTT (Over-the-Top)

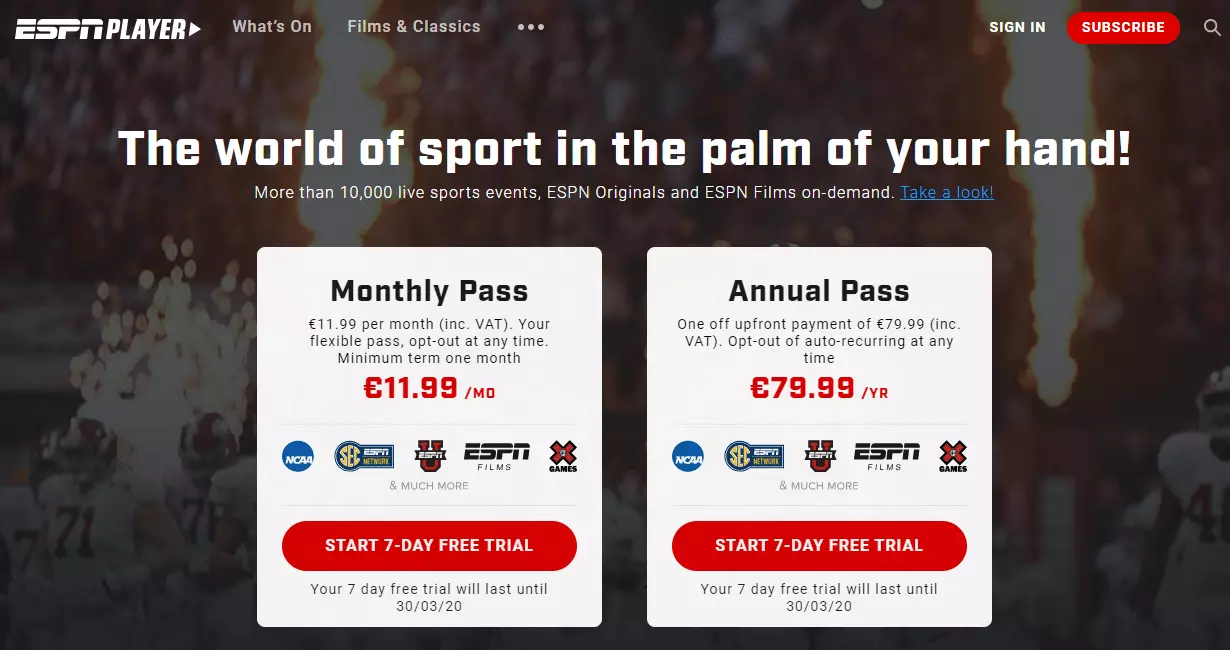

Over the past decade, videos have been an integral part of the content mix for ESPN and contributed most to the revenue. But it was restricted to Cable networks, radio networks, and Web. So, the parent company launched ESPNPlayer, an OTT service, for the visitors.

The visitors are required to buy the subscription to get access to the content and in the exchange they get the choice to select the content length and subscription duration. Though the player is accessible to limited countries, the publisher has offered 10,000 live events by the time we wrote this article.

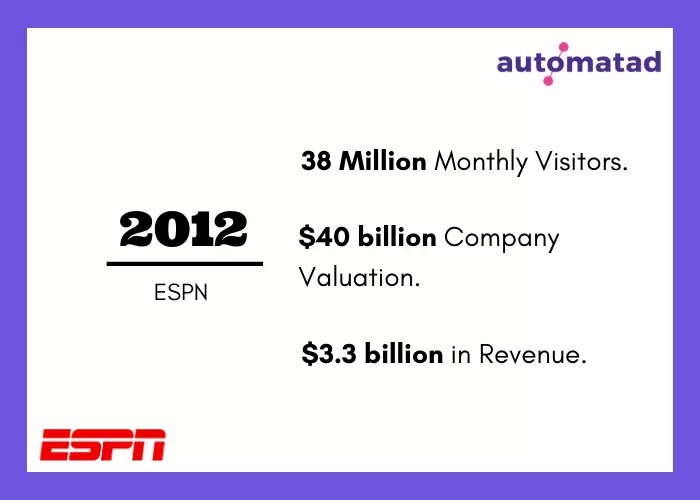

By 2012, the company was valued $40 billion and earned $3.3 billion in revenue. (Src). And, it attracted 38 million website visitors every month (Src).

In 2012, Real-time bidding and ad exchanges were quite new. Yet, it didn’t stop the publisher from experimenting with it. ESPN is one of the earliest publishers who relied on RTB and SSPs and included it in their long-term strategy (Src). The same year ESPN laid the groundwork for Real-time bidding and started serving ads via Admeld on one of its subsidiaries, ESPN Star Sports.

The ad server helped the publisher to serve, manage and optimize innovative ads. Besides, it also provided audience data to the publisher to improve the targeting of ads. However, after the acquisition of Admeld by Google, the publisher moved to Freewheel and again to Google Ad Manager and Ad Exchange to monetize the ad inventories. We will discuss it later in the article.

ESPN App Launch

At the end of 2013, the publisher redesigned ESPN SportsCenter app for the users. Since the previous version wasn’t user friendly, the publisher realized that the app needs to be redesigned in order to serve the app users.

Was that the first time when ESPN redesigned the app? Not at all. In fact, ESPN SportsCenter isn’t the first app of the publisher. The publisher has been distributing the ESPN content via several apps such as ESPN fantasy app, ESPN radio apps, and so on.

The parent company releases an app more often than anyone else depending on the upcoming seasonal sports. When it comes to the Olympics, there will be an ESPN Olympics app. Till the date, ESPN apps have been downloaded by more than 50 million users in the Google Play Store.

“From smartphone to the 60″ television in your family room, ESPN products need to both satisfy the fan’s need in that situation AND take full advantage of the device itself.”

– Ryan Spoon, SVP of Product, ESPN

ESPN Traffic in 2013:

Partnership with Google

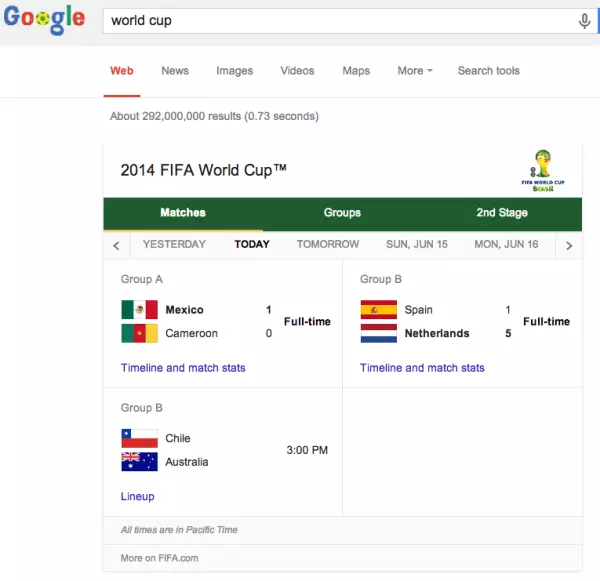

Why though? Everybody knows how important Google is for sending traffic to a website. In this direction, ESPN partnered with the search engine to increase the website’s traffic during Football World Cup 2014. How come Google agreed on this?

Since Google didn’t have the rights to display the World Cup games and clips, it thought to get in this deal as it was beneficial to both sides. The publisher has a dedicated website for football, and Google leveraged the display of the latest updates and scores. It took the screenshots of scores and displayed it at the top of the search engine results pages.

Image source – Src

Though the two companies stated that they wouldn’t be sharing ad revenues as well as paying to each other, this partnership helped the publisher to increase the traffic substantially.

Fighting back against Ad Blockers

Adblocking was growing and was up by 41% than the previous year 2015 (Src) – reducing the publishers’ ad revenue worldwide. ESPN was going through the same. With growing advertising on the websites, users started installing ad blockers. This led the publisher to leave money on the table.

ESPN that has been primarily relying on pre-roll video advertising found 9 out of 10 video ads were getting blocked by Chrome and Firefox (Src). Due to similar challenges, the publisher wasn’t able to monetize the mobile web. So, to mitigate the loss of ad revenue due to ad blockers, the publisher implemented Server-side Ad Insertion (SSAI).

“Issues arise in client-side scenarios where one call is made for an ad and another to render content, which results in those spinning wheels or delays. People are looking to remove that friction.”

– Mike Green, Vice President, BrightCove

Server-side Ad Insertion stitches the ads to the content on the back-end and takes place between the ad server and video player. For CTV or OTT devices, a publisher usually needs a tech expert as it requires SDKs and other integration to Apple TV, Roku, etc. And, ESPN already had a huge team of developers and tech experts.

“Server-side ad insertion opened up new mobile web monetization potential for ESPN and subsequently smoothed out the user experience.’

Advertising and OTT Challenges

From 2017 – Present

Self-serving Advertising

At the beginning of 2017, Facebook wanted to automate publishers’ direct selling of video ad inventories from Facebook via its Audience Direct platform. With the help of its self-serve platform, Facebook tracked the ad impressions that were viewed by the audience on ESPN’s different properties.

“It’s a new tool that allows publishers to sell their ad space directly to advertisers using Facebook’s ‘people-based’ system,”

– Brain Boland, VP of Publisher Solutions, Facebook

The publisher integrated Audience Direct to get access to the demographic information of the video viewerships. This direct-selling helped ESPN to set up the advertising deals and target the ads with 90% accuracy as said by Facebook. The program was free to join when it was under beta, but the publisher had to pay a small fee later when Audience Direct was officially launched.

Did it help ESPN to improve its advertising capabilities? Yes, somehow. However, very soon, many publishers realized that this is Facebook’s attempt to take away traditional TV dollars and ways to gain access to more original programming (Src). So, the publisher decided to enhance ad targeting with in-house and dedicated ad serving products.

OTT Challenges

The industry was catching up with OTT viewers and 96% of respondents expected digital media companies to produce OTT content in 2018 (Src). ESPN was already accessible on Chromecast, Apple TV, and other OTT devices.

The audience base was strong enough. But, there was one challenge – identifying the users on different devices. OTT devices do not have a standard device ID that can work across all devices. Every device has its own ID and different mechanisms to integrate with the platform.

“We’re trying to figure out how to create proxies for that OTT viewing, and how to measure or target against that [proxy] (Src)”

It was certainly challenging for the publisher as advertisers were rushing to place ads on multiple devices. Despite ESPN’s surging popularity, the parent company was forced to find solutions to unite the fragmented ad inventories and help the advertisers to improve the targeting abilities.

Onboarding Google Ad Manager

As advertisers were demanding quality and experiences that are seamless, relevant, and measurable across all devices (desktop, mobile, app, and OTT). So, the publisher moved from Freewheel’s ad server to Google Ad Manager to serve ads on the web, mobile apps, and other devices.

“We value all our partnerships and have great momentum in bringing on broadcasters, cable operators, live sports and video publishers to power their video businesses across screens, but Disney is significant because of its vast, premium global content.”

– Shane Peros, Managing Director of Global Partnerships, Google (Src)

Via this partnership, advertisers are now able to find their relevant audience and target them efficiently across different channels of ESPN with a single buying option.

“As Disney Advertising Sales transforms how we engage the marketplace, delivering truly distinctive advertising solutions across our brands and media through a one-stop-shop, this agreement will ignite further innovation,”

– Disney.

First-party Data Usage

If you have been in digital publishing and advertising for a while, you might have an idea of how first-party data is going to dominate over the next few years. In the case of ESPN, the publisher partnered with a data management firm, Bluekai.

“We’re making sure we’re doing this in a privacy-safe way.”

But, before onboarding with Bluekai, the publisher analyzed the ESPN Analytics data to understand its audience. With Bluekai, ESPN assessed users’ behavior segments to accurately target the audience. Besides, the publisher created surveys to create segments and predict which person is more likely to convert.

Delivering On-Demand

April 12th, 2018 was the debut of ESPN+, a premium, subscribers-only service from ESPN. The paid video service offered a lot of stuff that visitors didn’t typically watch on ESPN properties. ESPN+ that is basically an improved version of the ESPN app was launched with a 7-day free trial.

After the trial period, a subscriber is asked to pay $4.99 per month or $49.99 per year to access the ESPN content. ESPN+ streams more than 10,000 live sporting events. Surprisingly, the publisher achieved 568,000 subscribers in just two days (Src).

“Very quickly, a wide range of sports fans have seen the value of ESPN+. With high-quality programming and an outstanding user experience, ESPN and DTCI [Disney Direct to Consumer and International] are expanding the ways Disney is serving sports fans.”

– Jimmy Pitaro, President, ESPN

As announced by the parent company, the future of Disney is streaming and the past is linear cable television.

“The biggest challenge that ESPN+ will face is convincing people that it’s not just some paid mishmash of stuff that ESPN finds unworthy of its core, traditional channels.”

So, how did the publisher face the challenges and boost the subscriptions? Answer to this question is – content bundling. Disney announced that if visitors want to access ESPN+ content, they can buy Disney+, Hulu+, and ESPN+ together at $12.99 per month.

Since individual subscriptions to the programs cost $19 per month, content bundling saved $9 every month for the visitors. At the end of Q2, 2019, ESPN+ had 2.4 million subscribers according to a resource. And, by the start of 2020, there are more than 7.6 million subscribers to ESPN+ (Src).

Conclusion

As stated above, ESPN is a flagship network that reaches hundreds of millions of visitors every month, more than any other sports website. Every week, the publisher produces 500+ video content featuring exclusive content, interviews, and more. One has to experiment and pick up the best for their business and that’s what ESPN did. They were able to stay ahead — from RTB to video ads to OTT — because they were constantly looking out for ways to improve the business and experiment. So, what ESPN strategy did you like? Let us know in the comments below.