Table of Contents

Why The Economist?

The Economist has been a weekly newspaper covering current affairs, politics, international business, and technology in a comprehensive and data-driven fashion since its inception in 1843. Since then, the publisher has been growing at a tremendous pace and has made its presence in 14 countries.

The publisher attracts nearly 13 million monthly visitors to the website and generated an operating profit of £41.8 million in 2020 (Src). Over the years, The Economist has developed a distinct focus on digitally-driven propositions, launching various products to develop revenue growth.

Without further ado, let’s look at the journey of The Economist and break down their interesting strategies behind this growth.

Discretion: In this case study, we would also be focusing on the data for the parent company of The Economist, aka The Economist Group.

How it all started?

1996

A well-known magazine, The Economist had built a large and loyal following by 1996. Now, it was time to expand the possibilities of the brand, and create new opportunities to help the organization grow. Taking a step forward, the publisher launched its web version in the same year.

At first, the website promoted the print edition of The Economist alongside other websites such as Roll Call and The Journal of Commerce. Slowly, it made available all of the academic papers and research on economics, demographics, technology and telecommunications, politics, and social issues. The book reviews and several surveys were also a particular draw of the website, as The Economist’s literary critics proved to be trustworthy and thoughtful.

Where are they today?

As per The Economist’s annual report, the operating profits for the Group have increased to £41.8 Million, on total revenue of £310.3 Million in 2021, up by 27% from the previous year. The publisher has also recorded the largest ever growth in subscriber numbers as it grew by 90,000 in 2021 to reach over 1 Million subscribers.

In terms of social media growth, the publisher has more than 26 million followers on Twitter, and 10 million on Facebook. As of now, The Economist attracts 12.5 million monthly visitors to its website. The main traffic sources for the publisher have always been direct and search. Here’s a breakdown of their latest traffic referrals:

Becoming The Economist – The Early Years (1997 – 2003)

1997

Setting up the website

Till the first half of 1997, the website economist.com remained the same. Soon, the publisher wanted to make sure that anyone who visited the website could find the information they needed when they needed it. It was therefore important that the design of the website should be flexible and also could scale in line with their future plans. So, in June 1997, a new layout was introduced with some major changes.

The new website had been redesigned to be more user-friendly and incorporated many of the features readers had requested over the months. All of their favorite features were added but now they were more streamlined. It also included a digital subscription that would allow users to sign up for The Economist’s premium content for $48/year.

This was an attempt to try new strategies with their content in the hopes of attracting more people to their website and converting them into paid subscribers. To further increase the subscriber base and at the same time website traffic, the publisher had a radical idea – offer the premium digital content for free to the print subscribers.

Is this a good move for every news publication? Maybe yes. Maybe not. But it does seem like a step in the right direction for The Economist.

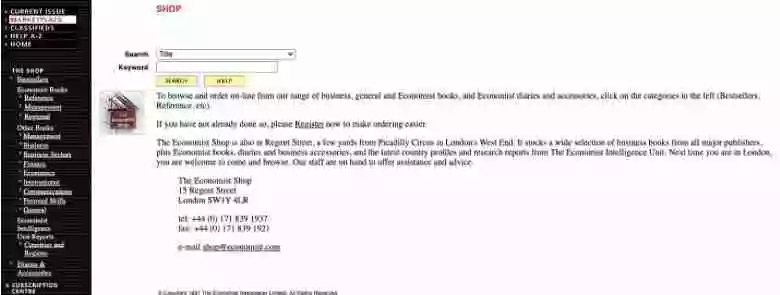

The Economist Shop

The rise of the Internet and the advancements in technology were about to change the way of thinking. Publishers were now intrigued by newer ideas which included figuring out the possibility of earning income from multiple sources. As more and more online users were popping up online, it became increasingly crucial to monetize them. With the growing scenario of digital storefronts, an eCommerce store seemed to be the best way to increase the ROI for a business.

So, the publisher launched The Economist Shop, an eCommerce platform that served three primary purposes: improving the digital user experience of The Economist’s physical visitors, making it more convenient for users to purchase physical products on the website, and encouraging subscribers to remain as valuable members of The Economist community.

The goal was to leverage the brand power it had from its print magazine and physical stores, to expand its brand into a new online business-to-consumer market segment. The new online store was able to sell not only all of their books but also products from third-party publishers through a commission or referral framework. The Economist Shop also managed customer data on-premise and gave customers a chance to leave reviews, create wish lists, and discover related titles.

The Economist Intelligence Unit

At first glance, it was apparent that they were offering books and other products. But what piqued our interests, even more, was The Economist Intelligence Unit. The objective was to help Senior Business Executives make informed decisions about world events, strategy, and risk. The publisher examined economic trends, political risks, country forecasts, and business environments for various countries.

With prices starting at $250 a year for a single report, The Economist Intelligence Unit was one of the costliest services of the publisher but also provided a unique value proposition. As a leading provider of global business intelligence, EIU covered important news, acted as a mentor to millions, and helped bring clarity to global issues in addition to offering leadership positions through insightful reports.

Since then, The Economist Intelligence Unit has been providing the world with political, economic, and business insights. Given the massive clientele and wide array of information, The Economist has to offer, coupled with their history in the industry, they have carved a niche for themselves in the global market. What began as a small simple service has now become a renowned service.

Making money by selling classified ads

Classified advertising has been hugely popular with print publishers. And for good reason — it’s one of the few ways that publishing could generate significant revenue. Businesses often used print classified ads offered through ad networks to promote their products and services.

In general, when an advertiser posts an ad, they pay you in exchange for helping them to attract potential customers for each click. When it comes to digital classified ads, they have a wider reach, are quicker and more efficient than print classifieds. As the publisher had a wealth of experience in working with local and regional advertisers, it enabled the brand to efficiently manage campaigns for all types of classified advertising, including jobs, business services, and online courses.

“The website hosts classified advertising for prestigious companies and universities. Advertisers can take advantage of web functionality by including colour images, e-mail addresses and links to their websites in online advertisements.”

– The Economist (Src)

Doubling down on display advertising

To better serve advertisers and increase ad revenue, the publisher introduced digital display ads on the website in 1999. It was a bit revolutionary at the time because they had always prided themselves on a subscription model. With this change in advertising strategy, The Economist has entered a new phase of growth and is accelerating its already rapid pace.

In addition, we have successfully carried out several pilot portrait campaigns to test the effectiveness of various advertising formats. We are now ready for advertisers to buy more fully into this new model of integrated advertising throughout The Economists properties.

Turning newsletters into a revenue model

Emails have been used for years in order to promote businesses, but the internet created new ways to monetize them. Just like other brands, the publisher realized that getting your customers to buy more was easier than you think. So, it started monetizing the mailing list. Wondering how? It was straightforward.

The publisher allowed advertisers to advertise in a way that would give them the ability to have their ads be seen by their newsletter subscribers. Since The Economist had high open rates, the notion of maximizing effectiveness encouraged more advertisers to get on board. The result of this newsletter monetizing method was an increase in ROI for advertisers as well as the publisher.

Snapshots of HTML and email newsletters delivered by Economist.com

Revenue Diversification (2004 – 2011)

Offering microsites or hosted content

Since the inception of the Internet, microsites have been designed to provide one specific service with one specific goal in mind. They have fewer pages than a regular website and therefore, users don’t have to search through multiple pages in order to find what they are looking for. Having a microsite is a great way for publishers to generate traffic and increase user engagement with their content by promoting something specific.

Typically, publishers leverage microsites to improve their organic rankings and SEO. But when it comes to The Economist, the publisher launched a new advertising model. It started offering microsites to advertisers and delivering relevant content to its users. At the same time, the publisher provided the right audience to the advertisers.

With this in mind, The Economist offered advertisers the chance to create a bespoke microsite that would be geo-targeted to specific regions and audiences. This would contain promotional ads that would deliver their traffic directly to the advertiser’s website – replacing traditional banner ads.

Moreover, in order to give them complete access to the audience, the publisher leveraged the Roadblocking technique. This model gave advertisers more control over the ad inventories and the targeting of their ads; while providing readers with more relevant content on a local level. For advertisers, this geo-targeting allowed for a greater degree of granularity than is possible with other advertising mediums. On the other hand, The Economist achieved higher prices for its ad inventories.

Let’s get started with podcasts

In today’s world, when everything is moving so quickly, where content needs to be updated daily and where people like to consume news in multiple formats, The Economist realized that it needed to change its approach in 2006. The publisher dived into the world of audio and added the first podcast to its website.

At the time when brands were increasingly producing their news in text and pictures, it might seem odd for The Economist to be turning to audio. However, the publisher believed that podcasts could broaden their appeal to a younger audience as well as improve “stickiness” – encouraging readers to spend more time on the website.

The main reason why the publisher started using podcasting was that they saw it as an opportunity to attract a new audience of listeners who are willing to audio content and advertisers who are trying to reach those audiences. To do this, The Economist offered 10-second and 30-second audio ads based on their placements (prior to the podcast or after the podcast content).

First foray into mobile devices and subscriptions

In 2010, The Economist launched an app for iPhone and iPad as part of its strategy to diversify the platform on which it provided content. The publisher was eager to reach as many readers as possible, thus it was important for them to have a presence on handheld devices. By creating a free app for subscribers, users could access The Economist from their mobile devices and gain access to their full range of content at any time.

The app included all of the content from the print version as well as the digital version and was fully integrated with social media sites such as Facebook and Twitter. It featured a streamlined interface that allowed users to easily browse through articles, play video or listen to audio interviews, view photo galleries and access a glossary of terms used in each edition.

“With the growing popularity of mobile devices such as smartphones and tablets, like the iPhone and the iPad, which offer an immersive reading experience, we are seeing strong demand and as a result a big opportunity for a publication like ours is emerging.”

– Oscar Grut, Managing Director of Digital Editions, The Economist (Src)

The Economist’s app had certainly expanded its user base and potential market share in both the United States and worldwide. According to the statistics, the publisher had over 2.5 Million downloads within six months (Src).

By the mid of 2011, Android users were in for a treat as The Economist had rolled out its new app for the Android platform. Tapping into the growing trend of “snackable content”, the app allowed readers to quickly scan headlines, stories, and videos in a way that suits their busy schedule.

The new Android app worked just like the iPhone app and offered the same service of personalization, which meant that users could create their own newspaper and receive articles from various sections of their choice.

Programmatic Foray (2013-2016)

Breaking through the content clutter

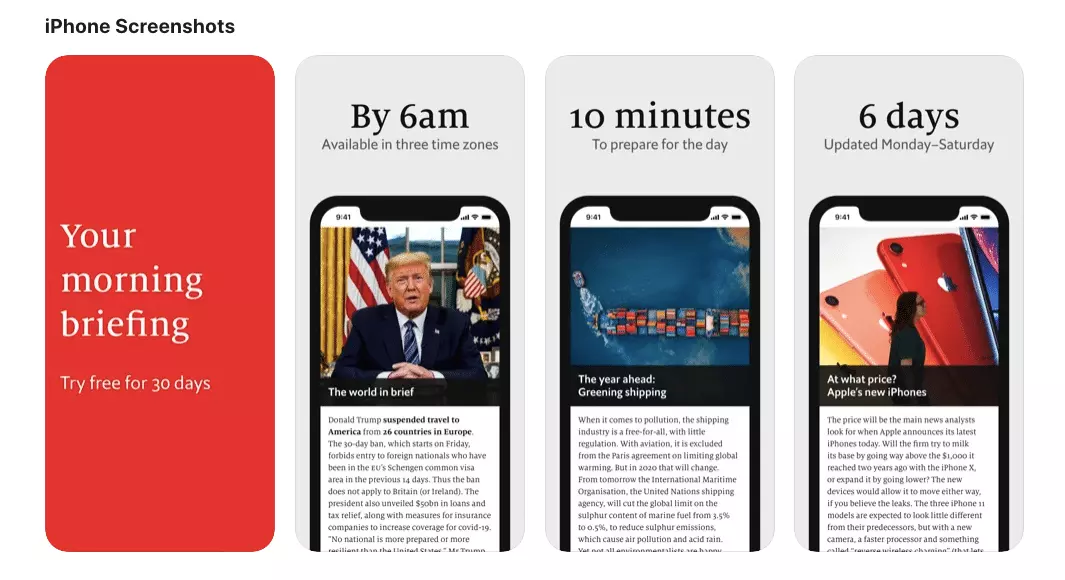

In a world where we get bombarded with information from all sides, it seems that the more information we have, the less we know. So, to break through the content clutter, the publisher launched The Economist Espresso, a daily newsletter that offered a summary of the latest news and updates from The Economist.

“One of the reasons the weekly Economist has done well is, you feel you’re completing it. We’re trying to give you a sense of being out ahead of the news. To tell you what’s going to happen and tell you what to think about it.”

– Tom Standage, Digital Editor, The Economist (Src)

The primary goal of The Economist Espresso was to combat information overload by providing users with a concise way to stay informed about the news. The publisher hoped that by doing this they would be able to retain their old subscribers as well as gain new ones by offering them a service that made it easy to be up-to-date with everything that mattered.

The Economist Espresso was presented in an easy-to-read format and could be downloaded as an app or subscribed to through email. Available for a price of $4 per month for non-subscribers, existing subscribers could access this product for free.

“The weekly [edition] works as much for what we leave out as what we leave in. It is the same principle with Economist Espresso. This new daily briefing will expand our reach and utility as a smart guide to the forces that shape the future.”

– John Micklethwait, Editor-in-chief, The Economist (Src)

Premium Advertising Campaigns

At a time when more and more readers were rapidly switching between their smartphone, tablet, and laptop to view content, it was important for publishers to offer advertising that is equally mobile and multi-platform friendly. When The Economist noticed this (~40% of users consuming content across multiple platforms), it introduced a premium advertising product known as First Impression.

To be specific, First Impression was a multiplatform ad unit product that enabled the advertisers to reach audiences based on their engagement rates. The publisher partnered with PricewaterhouseCoopers and created Total Economist Weekly Audience (TEWA) that offered insights into how The Economist’s readers are consuming its content and thus, delivering relevant ads on the website.

“We are excited that advertisers will have the chance to embark on this industry ‘first’ with The Economist and will see our vision for true multi-platform marketing.”

– Paul Rossi, President of Group Media Businesses, The Economist (Src)

The First Impression package by The Economist was a win-win situation for both the reader and the advertiser. The reader got to read The Economist on multiple platforms with less intrusive ads and the advertiser got to be associated with a prestigious brand. What’s more – the package offered a guaranteed set of ad impressions across all platforms, hence it acted as a sort of hedge against remnant inventory risk.

“We tell advertisers that if you believe in the Economist audience, you might like to get your message in front of them everywhere they are and can we create a premium package that gives you first access to each individual.”

– David Kaye, CRO, The Economist (Src)

Betting on user attention-based media selling

In an era of programmatic selling, publishers were looking for ways to unlock the value of their audiences and optimize the ad campaigns for higher revenue. While a majority of publishers were selling ad inventories based on CPM or CPC model, The Economist was one of the rare publishing brands that decided to opt for the CPH (cost-per-hour) model. Instead of relying on ad viewability, the publisher believed that time-based selling was a way it could trade ‘user-attention’ and assure the advertiser that they are buying for quality and meaningful impressions.

The publisher partnered with Moat and Chartbeat to understand user behavior accurately and created a model that charged advertisers for impressions generated over 5 seconds of active view time. They were quick to realize that viewability did not equate to user attention.

“Viewability doesn’t provide attention. It is a proxy for quality. The next step in the evolution of media buying is trading attention.”

– Ashwin Sridhar, Global Head of Digital Products Revenue, The Economist (Src)

The publisher’s time-based ad selling structures differed based on the devices. In the apps, the ads were served along with the app’s content. Advertisers had to buy 700 hours of time-guarantee sponsorships for a global campaign. On desktop, the publisher followed a CPH model where it also traded in CPMs and sponsorships. But the ultimate aim remained attention-based buying.

Further, the publisher used Neilsen to measure the effectiveness of this time-based ad selling model and optimize the campaigns. For example, The Economist partnered with a jewelry brand and enabled them to uplift brand awareness between 0.4-5.2%. The click-through rates for these ads were also higher when viewed for 5-30 seconds when compared to the CTRs of the ads bought via the CPM model (Src).

“Advertisers are OK paying a premium for viewability, as all publishers are charging this. But in focusing exclusively on viewability, advertisers are compromising on user attention.”

– Ashwin Sridhar, Global Head of Digital Products Revenue, The Economist (Src)

Adding another social platform

In 2016, The Economist started publishing on the popular Japanese messaging app, Line. The new social media platform had over 212 million monthly users and it looked like a great opportunity for the publisher.

The publisher created a dedicated team of 2-3 people in order to ensure that the posts were strategically edited to cater to a global audience with platform-specific formatting. It also expanded the breadth of topics and started publishing posts from their digital edition on the Line homepage.

Videos from Economist Films, pictures from the publisher’s image desk, or lifestyle articles from 1843, the publisher’s sister magazine, also found a new place on the Line app. While the number of posts per day remained roughly the same, contents related to Indonesia or Thailand (the countries with a huge Line following) were promoted via push notifications.

“Some publishers are busy chasing traffic through Facebook and Twitter; it’s not uncommon for these more niche platforms to become an afterthought. For us, [Line is] so interesting because of the mix of readers; it’s definitely been worth investing [in it].”

– Sunnie Huang, Social Media Writer, The Economist (Src)

Slowly, the publisher increased the frequency of push notifications from 3/week to 1/day. Since some of these articles were behind paywalls, this allowed the publishers to encourage readers to subscribe.

The publisher also noticed that push notifications were 10 times more successful in driving referral traffic. It was almost the same amount of traffic that Facebook and Twitter posts generated for the publisher. While this app wasn’t meant to be a huge driver of traffic, the following on the app grew to almost 1 million in several countries (Src).

The Five Year Plan (2017-Present)

Effective usage of data

Data always comes at the forefront for The Economist. However, as strange as it may sound, it wasn’t until 2017 that they could actually make sense of their complete data, which included subscriber data and browsing data that they collected. While they had huge amounts of data, they had no tool to analyze and make sense of this data.

It was difficult to understand the type of content their most loyal subscribers viewed or their behavioral patterns. Despite having access to data platforms, they had no way of overlaying the same with their own first-party data since it required seeking and matching data from multiple data points.

So, they started using Looker, a tool that allowed the publisher to combine data from multiple sources and understand it from a content behavior perspective. This enabled the publisher to create richer audience data pools so that they could use it to target them. They made the process more efficient by further overlaying it with data obtained from third-party sources like BlueKai.

“We already trade our audiences on other platforms via our extended network, which was a simple pivot. This is the next iteration, where we can help brands manage their own retargeting. We can share audiences with each other and create bespoke targeting,”

– Stephane Pere, Chief Data Officer, The Economist (Src)

Not only did this help the publisher improve the user retention capabilities, but also encouraged them to test newer ways to increase user engagement. Through the means of A/B testing, Looker enabled the publisher to try and test the methods which work the best. They also started tapping into their own audience data and combining it with marketers’ data to facilitate the selling of acutely targeted digital ad campaigns (Src).

Getting started with videos

It was 2017. While most of its views came from Facebook, the publisher soon noticed that audiences were turning their attention to YouTube and engagement was also becoming higher. Questions that demand attention were trademarks of these videos. This was in tune with the wry humor that the publisher likes to flaunt.

However, the videos were not just used to drive audience engagement but to also monetize them with ads. Some of the factors that The Economist considered to understand whether they were using video correctly included:

- Were they creating content in the correct way to make the audience engage with the brand?

- What role did video play in helping those users become subscribers of The Economist?

- Did video play a role in driving user retention?

The results were soon noticeable. By June 2019, The Economist already had close to 900,000 YouTube subscribers (Src). Other things that the publisher noticed include a marked increase in subscribers from referral traffic generated via their YouTube channel.

Seeing the profitability that The Economist Film division was raking in, the publisher made the decision of integrating it with their advertising department. This gave the Film division access to the existing advertisers and also allowed them to build long-standing relationships with them.

Partnering with Lytics CDP

While they had been developing ways to target users with tools like Looker, it was their decision to partner with the Customer Data Platform Lytics that started showing them real results. In a bid to serve the right ads to the right people, The Economist partnered with Lytics to collect data from multiple sources, de-anonymize it, and weave it together to form distinct user profiles.

These user profiles enabled the publisher to analyze their audience behaviors more accurately and share the data with their marketing channels to locate and target new users. As a result, The Economist was able to decrease their acquisition costs by 80%, and triple their digital subscriptions. Combining customer data, AI, and machine learning, The Economist leveraged its 300% increase in sales and subscriptions to bring forth profitable results for its business (Src).

Capitalizing on Instagram Audience

Similarly, The Economist undertook a unique strategy influenced by data-driven Instagram stories and compelling visual storytelling. The publisher found that Instagram served as an ideal platform to drive engagement as it encouraged its followers to indulge in a conversation on the various topics they posted. They also understood that choosing an optimal time to post content was key in driving user engagement.

Focusing on the quality of engagement was also important as the publisher intended to spark debate. In trying to build a community on Instagram, moderating posts are just as important. Said that, keeping a close eye on in-app analytics such as audience demographics, interaction, and discovery also proved to be hugely beneficial for the publisher. A/B testing new formats used on Instagram to drive engagement was also crucial in understanding whether one format worked better than another.

“Considering audience behaviour from the start is key as we begin scripting the story. Often a question or statement on the first slide will frame the narrative. We think carefully about which information to front-load to best grab attention and where to place poll stickers to get viewers to engage with the story,”

– Ria Jones, Instagram Editor, The Economist (Src)

Other aspects that the publisher prioritized included native elements in Instagram, such as the multi-poll option on quiz stickers, and the script used to create the stories. The script was extremely important as it helped transform the data-heavy reports of the publisher into Instagram-friendly stories, increase user engagement and redirect them to Economist.com.

“We decided to incorporate the poll feature into other formats. And when Instagram developed the multi-poll option, that freed us from the constraints of a two-way multiple choice poll. This function is great at increasing engagement whilst gauging our audience’s response to the subject matter.”

– Ria Jones, Instagram Editor, The Economist (Src)

As a result of these strategies, The Economist was able to gain 3.4 Million followers on Instagram (Src) by June 2019.

Should you focus on LinkedIn?

The Economist says, yes. The publisher has shifted its focus over the last three years to target a professional audience on LinkedIn. The Economist has been using LinkedIn as a publishing platform for years. Initially, the publisher used the platform to promote its print and digital content. Due to LinkedIn’s predominantly business audience and layout, The Economist’s editorial team tweaked the way it wrote and edited stories for the platform to make them more digestible, introduced more data visualizations, and structured articles around questions that readers might ask.

The publisher has to ensure it is creating an experience that doesn’t alienate readers—for example, by promoting too many new stories. It also has to balance the number of posts and at the same time, build reading habits. Moreover, the social media at The Economist also used various tools to analyze reader demographics, and decide what stories will appeal to which audiences. For instance, a video about Brexit might be more successful with U.S. audiences than European ones, so could be targeted accordingly.

“LinkedIn has changed over the last couple of years, it’s moved from a platform where you would get a job to [becoming] more content-focused. In the early days, The Economist brand would have stuck well with audiences who were out there looking for a new job and sharing our content.”

– Jack Lahart, Head of Social Media, The Economist (Src)

What was the result? The subscribers coming through LinkedIn increased by 3x and the number of followers increased by 39.5%. Not only these, but LinkedIn has also become the third biggest subscription driver for The Economist in 2020.

Conclusion

The story of The Economist is one that speaks of resilience and adopting the new in order to stay ahead of the curve. Having survived for more than 170 years, the publisher has a unique business model that helped it to remain successful. Having an impressive increase in subscriber numbers, the publisher has shown what it takes to stay on top in a digital world despite having the roots of a traditional publisher.

Their print strategy is to continue their success and allow The Economist to thrive in the digital world. The main reasons for its rapid growth are that it has diversified its readership group by providing extensive reading materials to its target customers, and it has developed a good reputation in such a growing media industry. The company’s well-thought-out policies have allowed brands to collaborate and grow together.

Wrapping up the case study, there is no perfect recipe for growth. You have to experiment with a lot of different strategies and see which one works best for your business. It’s also worth noting that readers should always be the center of attention when it comes to growing your business.

Liked the case study or have suggestions for improvement? Let us know in the comments and we’d be happy to hear from you.