Let’s be frank. Becoming one of the leading online publishers is quite hard. You’ve already experienced the rollercoaster with The Guardian. As we promised, we’re taking you again, this time with the Financial Times.

Table of Contents

Why the Financial Times?

Everyone in adtech knows ft.com for its whooping readership and successful paid membership model. But there’s more than what meets the eye.

They pioneered the online news space and have initiated the paid subscription model. They took the necessary risks and of course, had their struggles during the early years.

It took 7 years for Financial Times to get into the black.

In fact, they still do. Even last year, they only managed to get just ~£10m profit on revenue of £452m.

However, what pushed us to cover their story – Strategic decisions. Financial Times never hesitated to be the first and always bounced back after criticism. FT is one of the few media companies which profited in the midst of the 2008 – 2009 financial crisis (Src). Do we need any more reasons?

How it all started?

It’s often more convenient to look at how many million readers ft.com has today than to actually see their numbers back in 1995.

Yeah, the Financial Times made its online debut with the launch of ft.com in the middle of 1995. As you have guessed, it’s way too early. To put this into perspective, there were only 23,500 websites in 1995 with internet users summing up to just 40 million (of those, only 1.1 million users were from the UK) (Src).

Ft.com is one of the 23,500 websites in 1995.

FT.com didn’t even have a million visitors for the first four years. We couldn’t find the estimates, however, Pearson’s annual report suggests that the website crossed 1 million visitors for the first time during the 1998 – 1999 period (Src).

The website was more of a content syndication service drawing on over 50 million articles from 5,000 sources. All the profits were from the booming print advertising, ft.com didn’t make any profit.

At the time Forrester said the typical content-providing site will lose $2 million annually.

Where they are today?

FT reaches, on average, over 26 million readers every month and has over 714,000 digital subscribers. They managed to make £452.5 million last year as per a resource .

Does it look easy?

Because Pearson Plc and now, Nikkei (the parent of FT Group) both invested millions to revamp and improve ft.com and built in-house technologies to deliver results to the advertisers. From Live News to News Feed to Newsletters, ft.com offers a lot more than you probably think. So, it’s not anywhere near easy.

We can see an anomaly in the growth projections. Typically, a content site (legendary and pretty old) will grow its user base by 50x or 100x (take The Guardian for example) in two decades. But ft.com reaches only 25 million.

Well, that’s Financial Times. They are peculiar and precise in their marketing strategies and content creation. Reaching the most influential people and business decision-makers is their goal. Nothing more, nothing less.

Becoming The Financial Times

Online Foray – A Great Risk

1996 – 2001

In 1996, the Financial Times reached a readership of over a million spanning 160 countries, with a worldwide circulation of 300,000. FT had five times (appx.) the readership of the Wall Street Journal at that time.

What’s clear is that there is no need for Financial Times to invest heavily on the Internet considering it wasn’t working well. After all, it already had readers from 160 countries. What’s the need?

The publisher believed in changing consumer behavior. They realized that it wouldn’t be too long to see readers visiting online directories or websites to know what’s happening around them.

Net Team

It’s time to get back to 1996. Generally, large media companies would like to reach as many readers as possible and the Internet was the new shiny object promising global reach. But several media organizations failed in their attempts to capitalize on the Internet.

Limited bandwidth leading to congestion and discontented advertisements weren’t helping.

By July 1996, more than 70%of the commercial providers of original content on the World Wide Web including virtually all of the large high-profile mass media sites had disappeared or radically scaled back their operations. This prompted Don Logan, President of Time, Inc., to retitle the World Wide Web, “The Great Black Hole”.

– Global Electronic Commerce (Src).

Then, there’s ft.com

While others are scaling back, FT invested and built a dedicated team “Net team” to run and maintain ft.com. The team relies on advertising revenue to grow and sustain, which was considered a perilous move in 1996.

Experimenting with micro-payments

We know ft.com had a paywall from 2002. But they’ve been experimenting with it right from the start. Back in 1996, ft.com had a pay-per-view archive section offering access to four million articles. However, daily content is free.

“The site is all about giving the consumer a variety of options. We want to lock them into the subscription model as it is cash upfront and easy to administrate, but the key is to offer them the choice”

– Director, ft.com (Src).

More Than A Newspaper Duplicate

Though ft.com is a sister site to the Financial Times newspaper, the way the publisher designed the site is different.

Instead of regurgitating the news and layouts of its printed parent, the FT site is fast, efficient, and more importantly readable on-screen. Superbly illustrated and effectively laid out, the reader sees it as more than a print duplication.

– Asian Advertising and Marketing, May 2, 1997.

Speed, readability, user navigation, number of ads, etc. were considered and optimized to deliver a better user experience.

Growth in Digital Advertising

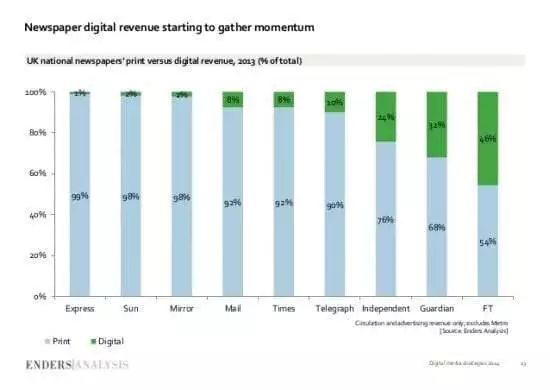

From making little to no revenue from its digital wing, the FT group started to see some promising results from the early 2000s. The Net team did their job well and digital accounted for 20 percent of the total revenue in 2001 (Src).

It’s Time To Put a Wall

2002 – 2006

We recently explained why it was early to put up a paywall in 2002. From the drop in advertising revenue to increased bounce rates, you have to deal with a lot. A normal publisher wouldn’t dare to ask its readers to pay for its content. That being said, the ft.com paywall strategy worked because of two major reasons.

a. FT has invested heavily and worked hard to build a competitive online presence and has been attracting the targeted audience (which are business people and companies). In case you didn’t know, there were several major sites revamps between 1998 and 2000 to ensure the readers are satisfied to the fullest.

b. It has the privilege of the specialist business paper. The readers are willing to spend for something valuable and ft.com has positioned itself as a reliable source to catch up with the financial front of all industries.

So, was it an immediate success?

Surprisingly, no. FT.com has been able to capture just 17,000 of its 2.8 million online readers. That means 99.39% didn’t care to subscribe (Src).

But the subscription model helped ft.com to break even after seven long years. By the end of 2002, following the subscription model and layoffs, ft.com became profitable (Src).

We attribute the success to both Times Online and Ft.com. Because Times Online led the charge along with ft.com to push the pay-for-content model. Both publishers used each other to build vibrant and familiarity among the readers. So, next time you see a paywall, you won’t say, ‘what is this?’

Slow Burn Approach

It’s easier said than done to convince users to pay for your content. Especially in 2002, when everyone else was happy to provide you the same (more or less) for free. So, how did ft.com eventually increase its subscribers?

A slow-burn approach.

Unlike the Wall Street Journal which forces the readers to pay £40 a year, ft.com took a slow approach. In the beginning, the publisher wasn’t seeing impressive figures from the subscription. It added up to just 5 to 10 percent of the total revenue from subscribers. However, they were too careful to not lose any readers.

And, indeed the approach was successful. The unique monthly users have grown to 3.5 million from 2.7 million and the subscribers have grown to 55,000 in the next two years (after the paywall implementation).

So, the paywall helped them to get into the black?

Well, it did. But there were other reasons too. As obviously, an increase in ad impressions and partnerships with elite advertisers to reap the best possible advertising revenue are some of them.

We’re trying to get Louis Vuitton into the pages of the Financial Times”

– Dame Marjorie Scardino, Chief executive, FT.

Capitalizing The Globalization

2006 – 2013

Besides being a quality-oriented publisher, ft.com also succeeds at taking advantage of a trend. For instance, John Ridding, CEO of Financial Times, briefed (on an interview with Ian Burrell) how the publisher has been focusing on the positive trends to stay in the black.

“In a time of industry disruption and fragmentation, it’s all about defining your audience and being clear about what makes you different and essential. For us, a powerful force has been the globalization of business. We have been in step with that trend and that strategy is paying off now.”

Truly a Digital Brand

We believe FT became a digital brand in 2009. If you’re considering the financial statements, you could argue differently. But we have a couple of factors to back up our notion.

- It skyrocketed its targeted user base to 11.4 million and generated 83.2 million page views. It had 1.4 million registered users too. Advertising revenue from the ft.com was allegedly closing in at £30m.

- The number of paying subscribers increased to 127,000 by December 2009 and the revenue generated from them increased by 43% (Src).

- They launched a new website howtospendit.com, which is an online version of the magazine ‘How to Spend It’. They’ve started to patch up the holes in the digital publishing industry and in fact, they revamped FTchinese.com the same year with added features.

- Most importantly, this was happening while everyone struggled to stay alive (the 2008 – 2009 financial crisis).

What more do you need?

However, it isn’t to say they had a smooth journey ahead. The publisher had to invest heavily in data analytics to keep its CPM study. And, they strategically increased their prices across digital and print. Besides, their 50% stake at The Economist has paid off well all along.

Global Marketing Campaigns

Even when you’re growing steadily, you need to supplement your strategies with online advertisements and marketing campaigns. It has become more crucial in the midst of news aggregators and competitors.

FT, as a century-old publisher, knows the same. They ran several global marketing campaigns building awareness, enforcing who they are, and what they stood for. One of the successful campaigns is “Global News At Your Fingertips”

To make sure they reach the right audience at the right place, the publisher adapted a channel-neutral approach, covering print, online, and television.

Digital > Print (Subscribers)

For the first time in history, Financial Times said they’ve crossed 600,000 subscribers and more than 300,000 subscribed for ft.com (Src).

Besides, online advertising continued to grow every year, trying to offset print advertising declines and losses.

What caused the growth?

– The successful marketing strategies and award-winning journalism.

– In 2009, the publisher started introducing metered paywalls based on user engagement. You can read up to 10 free articles per month.

We’ve already discussed the influence of the value-add model. As obvious as it seems, allowing the users to read what they need and gently reminding them of a paywall, works better. The same worked for The Guardian, but the ask for theguardian.com is ‘Contribution’.

First-Party Data

2013 – Today

Premium publishers demanding stellar CPMs have two things.

- They have the most-desired audience.

- They know how to let demand sources see the audience.

Rather than debating whether they have the world’s most-desired audience or not, the publisher focused on building the first-party data. In B2B, the audiences are finite and it’s not easy to scale or get the right data from the publishers.

“We’ve seen a big increase in a lot of our B2B clients who have been onboarding DMPs [data management platforms] lately because they understand that their first-party data, especially their customer files, are very powerful.”

– Whitney Powell, DWA media.

In an interview with AdExchanger, Anthony Hitchings, head of advertising technology and digital operations at FT.com said that “When we put the paywall up, which was back in 2002, we started to collect demographic data on users regarding their industry, business position, and their responsibility. And, for many years, we’ve also done behavioral targeting”.

And, when the publisher identified the uplift a DMP can bring to the ad operations and revenue, they decided to go with one.

Ad Inventory Management

FT.com can get CPMs as high as $90 or $100 when the audiences are executives and thanks to their data strategy for getting $10 CPM even for less desirable placements.

On top of these, FT.com had around 6.5 million registered users (not subscribers, registered to read 8 [numbers went down from 10]) free articles per month. The registered users provide basic information and interests which is enough for the publishers to show the right ads.

As far as ft.com is considered, we can assure you one thing. They are really strategic about their ad inventory management and wouldn’t want to put every impression at the same level. They segmented, valued, and then sold their ad impressions.

Forbes.com, one of the leading publishers does the same, and it follows a top-down funnel approach to ensure the ad impressions are earning the best possible CPMs possible.

Profits from digital operations pay about 75 percent of the FT’s editorial costs.

– Rob Grimshaw, Former Managing Director, Financial Times.

Our new daily email briefing #FirstFT launches today. It features must-reads from the FT and other sources http://t.co/kvggd10kea

— John Ridding (@John_Ridding) October 27, 2014

Sorry App Store, Data Is Essential

The great thing for a niche publisher is they’ll be able to draw a pattern to predict the user behavior after some sampling time. This, in turn, helps them to test and make informed decisions.

For FT, it was way easier as they collected enough data to know their registrants. The publisher learned to pick the newsletters which are sending them loyal readers who are likely to become digital subscribers. Hence, ft.com’s particular newsletter will be having offers that aren’t available to everyone.

Not just content, ads, they customized offers for the audience. When they realized the App Store isn’t allowing them to collect the planned data, they removed the app from the AppStore altogether.

Instead designed an optimized web app to meet their needs. It’s critical for any publisher to note the decision. It’s always important to rely on yourself, not on a third-party platform or social media network.

“We are happy to surface our first-party data… Why wouldn’t we add value by doing that? We’ve said that from day one. Every impression on FT.com has up to two dozen targetable data points against it, so our task is to bring that data together and create smart packages for our customers that help them reach the perfect audience target.”

– Jon Slade, Commercial Director, Financial Times (Src).

Audience Growth

If you’re a niche publisher targeting affluent individuals, there’s a big problem. It’s hard to grow rapidly as the other online websites.

While we all can look at the digital subscribers and simply say they’re doing good, the publisher has to deal with declining audience growth.

| Global business news category | ||||

| Worldwide desktop unique visitors (in thousands) | May 2014 | May 2015 | % Change | |

| 1 | EastMoney.com | 28,007 | 60,471 | 116 |

| 2 | MSN Money | 24,371 | 58,574 | 140 |

| 3 | China Economic Net | 55,476 | 44,881 | -19 |

| 4 | Yahoo Finance | 51,784 | 40,316 | -22 |

| 5 | Ifeng.com Finance | 39,501 | 38,138 | -3 |

| 6 | Sina Finance | 34,824 | 36,215 | 4 |

| 7 | Hexun.com | 48,869 | 35,590 | -27 |

| 8 | Sohu.com Business | 35,622 | 34,370 | -4 |

| 9 | QQ.com Business & Finance | 29,237 | 31,494 | 8 |

| 10 | Forbes Digital | 25,980 | 30,645 | 18 |

| 11 | 163.com Money | 24,105 | 27,657 | 15 |

| 12 | Business Insider | 20,207 | 24,578 | 22 |

| 13 | IBT Media | 20,689 | 24,479 | 18 |

| 14 | Dow Jones & Company | 30,561 | 24,475 | -20 |

| 15 | Bloomberg | 20,777 | 19,677 | -5 |

| … | ||||

| 61 | Financial Times Group | 4,630 | 3,400 | -27 |

First, let us convey why this is a real problem.

Let’s say ft.com has managed to reach 0.5 million new readers over the course of 12 months. During the same period, The Guardian, The Wall Street Journal, The New York Times can reach tens of millions. As geography is more or less the same, there’s a huge chance for overlapping.

Every day, other news sites and niche publishers are taking money from the readers’ pockets and eating their budget. Those who are late have to work harder to convince – Spend more on marketing and wait for them to subscribe.

Need a real-life example?

Financial data providers Bloomberg and Thomson Reuters (who are also running online niche publication to compete against ft.com) lost their market share to smaller rivals last year.

So, the first mover always win?

Of course, there is no reason to believe that ft.com will lose subscribers to rivals if it continues the slower pace. As we saw earlier, they took the slow-burn approach to woo readers. However, the (rapidly changing) consumer behavior isn’t a very good standard rely on.

It’s working for them now.

FT’s digital subscribers are up 21% year-on-year to almost 504K. Read the highlights from our 2014 results http://t.co/i3o4IssXks

— John Ridding (@John_Ridding) February 27, 2015

As a niche publisher, Financial Times didn’t fail to show promising growth and convinced Nikkei to put up a hefty price tag ($1.3 bn). Pearson, FT’s parent, was struggling to keep up its education business and decided to sell FT to offset the losses and revive its primary business.

Customer DNA

The Financial Times designed a breakthrough approach to a so-called paywall for digital content.

Ken Doctor says The New York Times copied the FT’s approach as F/T has been able to understand what the audience love to read, who’s reading what, when to charge and when to give something away for free.

The publisher has succeeded in figuring out their readers. They have got more than three dozen people in statistics (Src).

Ad-hoc System To Resurface Content

The Financial Times understood that 90% of their article views occurred within the 48 hours after the initial publication and dropped quickly thereafter.

You thought breaking news sites are the only ones with seasonal content, huh.

The lifespan of an article did not demotivate the social media editors, they decided to re-share relevant or highly popular archive stories on the Financial Times digital site as a way to engage with their readers, at a later date, without creating new content.

The editorial team had an ad-hoc system for identifying those pieces of archived content.

How?

– They accumulated mountains of data on readers and article activity.

– Imported it to a relational database management system.

– Combined it with three more data sets (search, social, and internal data).

– Used a third-party data analytics tool to draw out the insights and pick the right articles to resurface.

myFT

Financial Times released a revamped website (again) which loads faster and is more customized to serve the readers from the next generation. Remember, we highlighted that Pearson and FT worked together during the late 1990s to revamp ft.com (more than once) to cater to the evolving consumers.

They invested £200m back in the day. And, they still continue to do so.

“Words, pictures, data, and image combine seamlessly. Stories are not grouped according to old newspaper definitions, but to the way readers actually navigate, save and share their news.”

– Lionel Barber, Editor, FT

You can bet on them to evolve with the online readers. Besides, they know who are they targeting and what they need.

Digital-first Publisher – The revenue from digital exceeded print in 2016 making FT, the first legacy publisher to achieve the feet.

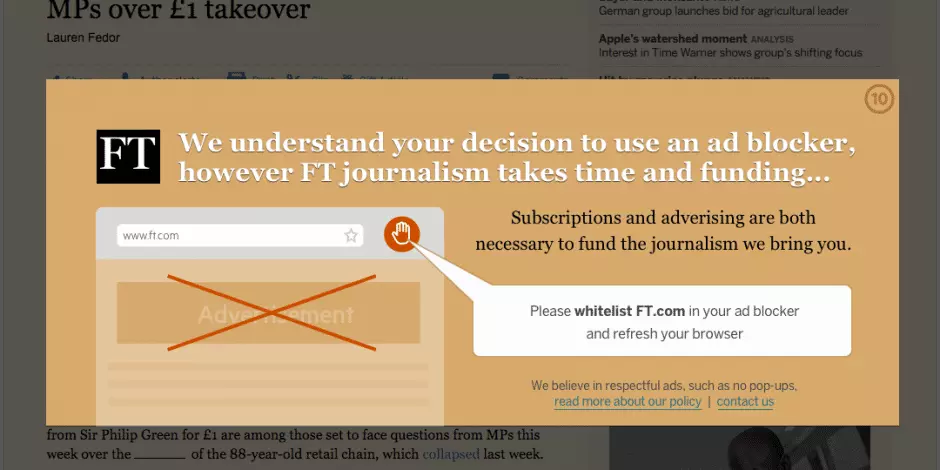

Ad blockers? We got another route.

Ad blockers are one of the perennial problems of ad tech. From long-tail publishers to legacy media owners, all struggle to get rid of ad blockers.

The number of people using ad blockers has remained mostly level on personal computers, with 257 million people using them monthly by the end of 2020., according to research by Blockthrough.

And, more often than not, premium publishers are likely to experience ad blocking and bypassing problems. While everyone has their own methodology to deal with ad blockers, FT.com has one of the best.

The success rate says so. The ad-blocking readers were tested with different options to see what worked well.

It took 15000 readers and categorized them into three groups implementing three different sorts of content restrictions.

One had completely blocked content with a message to whitelist, the second group had half-empty, half-filled words, and the last had nothing but a message asking to whitelist.

Surprisingly, 40% of the third group of people whitelisted even though they have complete access to free articles. Two-third of the first group whitelisted as they have no access at all. The second group was the least effective.

How you ask matters a lot.

Yet another example to prove the message works (if done right), is the Guardian. The publisher continually increased their contributors over the last 3 years.

Fight Against Spoofers

Not just ad blockers, ad fraudsters are also a ballooning issue for premium publishers. Fraudsters and spoofers specifically corrupt the supply chain of premium publishers to make sure they’re embezzling millions in a short period.

FT.com isn’t an exception. The publisher, however, took necessary steps to preserve their advertising inventory from spoofers and fraudsters. For instance, the publisher investigated to find spoofers (if any) disguising as Financial Times last year and found that 25 exchanges were being spoofed by fraudsters claiming to be ft.com. The fraudsters were making around $1.3 million a month, as per FT.

Two things to look at the experiment.

- Ad Exchanges, obviously accepting domains at scale, should have considered a specific technique to cross-check the veracity of the domains (especially premium ones).

- Domain spoofing is happening as we speak. It’s only a matter of time before you are made aware of it. It’s always better to partner up with trusted and genuine resellers. Don’t swoon for the premium CPMs as they don’t yield anything better (in the long run).

Knowledge Builder

FT tries to put their sophisticated data into action, always. A recent example is ‘Knowledge Builder’. It’s a tool built by the publisher to show how savvy a reader is in a particular topic. If the subscribers read some articles, it’ll show the most relevant articles based on the information they’ve consumed to offer them the complete picture.

“It aims to offer subscribers a more ‘satisfying read’, making it easier to find the content they need more quickly.”

– Caroline Scott of journalism.co.uk. (Src).

The publisher hopes Knowledge Builder could bring up to £1.5 million a year in revenue. What is more impressive is, the readers’ appetite for the content would eventually increase and they would feel more knowledgeable on a particular topic. Both are crucial for the long-term success of the publisher.

2019 – Today

Post-GDPR Advertising Strategies

Amid the hand-wringing and horror stories of plummeting display ad revenue for many publishers since the implementation of GDPR, the Financial Times had seen an undeniable increase in digital revenue for their programmatic efforts. In short, GDPR was great for the FT. Ask us how?

By capitalizing on Private Marketplace deals specifically Programmatic Guaranteed deals. Another interesting strategy here involved the usage of high-quality first-party data and more granularity of reporting and ad spend management.

“Post-GDPR a lot of buyers are asking, for legal reasons, how you collect and segment your data. Lots of publishers will say they have first-party data available, but no one was quite clear on who those people were. Whereas we’re able to show that, for instance, a CEO has declared themselves specifically as such on our site [thanks to subscriptions data].”

– Jessica Barrett, Global Head of Programmatic, Financial Times

Results?

In 2017, the Programmatic Guaranteed and Automated Guaranteed deals accounted for 4% of total programmatic ad revenue for The Financial Times. And by 2019, they accounted for 70% of overall programmatic revenue (Src).

Introducing FT Strategies

The idea that news could be a business — not just a service — was one of the reasons behind The Financial Times’ decision two years ago to launch a consulting business – FT Strategies. It provides a fresh perspective to traditional subscription models and digital publishing business advice.

To be clear, it works with publishers to thoroughly analyse their business, from a variety of angles and aims to find new paths for growing revenues.

“We feel quite strongly that a rising tide lifts all boats – when other publishers are succeeding with a reader revenue model and the idea of paying for quality news is more and more normalised, that helps everyone.”

– Tara Lajumoke, Managing Director, FT Strategies (Src)

Since then, FT Strategies has been running consulting projects for several clients such as Penguin Random House and Bonnier. The publisher not only helps the media organizations in the same industry, but also non-media digital entities (e.g. Direct-to-Consumer).

Conclusion

The story of ft.com is full of technological exploration, audience development, and strategic decisions. Though the print-side of the Financial Times is still struggling (as every other print media outlet), the digital revenue has been increasing steadily. With the Nikkei, the future of ft.com looks steady, to say the least. However, there’s still a long way to go.

It used social media properly (FT has grown their Instagram account from 40,000 followers to 286,000 in a year and the goal is to drive users to the site, eventually converting them to registered users/subscribers). In addition, you could see it offers a lot more than a typical niche publisher would. Starting from Lex Column to tens of newsletters to video series, it never failed to address the audience.

Staying on track is more important than beating the race.